Health Care Plans

How much you pay for coverage.

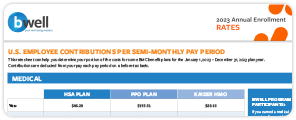

Employee paycheck contributions for medical coverage will increase for all medical plan options in 2023 to keep pace with rising healthcare costs. The costs you pay when you receive care, such as deductibles, copays, and coinsurance, are not changing.

On average, employer costs for health care will increase 6.5% to more than $13,800 per employee in 2023. BMC covers about 80% of this annual cost, and you cover the remainder. Faced with these cost increases, BMC applied the smallest increase possible to employees’ medical premiums for 2023 to maintain the quality you have come to expect from our plans.

| Per paycheck contributions* |

HSA Plan |

PPO Plan |

Kaiser HMO |

| You |

$46.29 |

$155.51 |

$86.16 |

| You + Spouse |

$174.05 |

$402.99 |

$246.46 |

| You + Child(ren) |

$121.49 |

$302.83 |

$169.91 |

| You + Family |

$236.67 |

$588.72 |

$359.63 |

You will pay between $100 and $600 less for medical coverage in 2023 if you earned bWell rewards by August 31, 2022, and chose medical premium discounts. You’ll see the earned discounts on mybmcrewards.com after you click on Enroll in Your Benefits.

To earn rewards and pay lower paycheck costs for medical coverage in 2024, join this year’s bWell program, Out of This World. Explore metaphorical galaxies while you (and your spouse) make lasting changes to your overall well-being.

Healthcare Flexible Spending Account contribution limit increase

The 2023 Healthcare Flexible Spending Account (FSA) contribution limit will be $2,850. You can carry forward up to $570 from 2022 for use in 2023. See 2023 limits on tax savings accounts.

Cost-saving tips when you need care

With inflation hitting everyone’s budgets right now, knowing how to save money when we need a medical procedure or service is good. BMC partners with BCBSTX to bring you tools to help you choose the proper care that meets your needs and is within your budget.

Health Advocacy Services—Call the number on your BCBSTX medical ID card to speak with an advocate. Advocates can help you identify ways to help you save money on health expenses before receiving a medical procedure or service. If you have questions or concerns about a medical bill, an advocate can help with that, too.

Digital Health Solutions—The BCBSTX medical plans include several digital resources to complement your one-on-one experience with your doctor. These programs are available at no added cost and can help you manage a health issue. Services include coaching and, in some cases, may use internet-connected biometric devices and wearable sensors to help you and your family achieve health improvement goals. Learn more here. Read about the newest addition to digital health resources, Learn to Live.

BCBSTX Member Rewards—Did you know you can shop and compare costs for over 1,600 health care procedures online using the BCBSTX Provider Finder tool? Just like shopping for new tires for your car or a new computer, doing a little comparison shopping can really pay off.

The price of health care services can differ by hundreds and sometimes thousands of dollars based on where you get care. Higher cost doesn’t always mean better quality. By choosing a cost-effective option for your care, you can save money on your out-of-pocket costs and could earn a cash Member Reward.

Take a look at these examples:

| Medical Procedure |

Provider A Cost |

Provider B Cost |

| MRI of the Brain |

$682 |

$3,849 |

| Knee Replacement |

$17,003 |

$61,980 |

How Do Member Rewards Work?

It’s easy. Just follow these steps when a doctor suggests a medical procedure or service:

- Log into Blue Access for Members at BCBSTX.com or on the app.

- Look for “Find Care.” Then you can look for doctors and hospitals. Do your search to compare your choices and select a reward-eligible location.

- Have the procedure or service at the reward-eligible location you chose.

Once the claim is paid, you’ll receive a check in the mail.